U.S. Tightens Grip on Europe Amid Russian Threat Germany Stages a Comeback

From Economic Powerhouse to Military Hegemony

• The veto power of small states

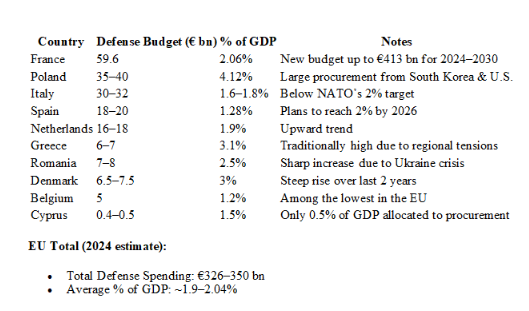

• Cyprus ranks last in defense procurement

• A fragmented European Union

By Dr. Yiannos Charalambides, International Relations Specialist

Germany is staging a comeback — and this time, it is resolute: it will invest 5% of GDP in defense. The long-debated “German Question” is back: Will Europe have a European Germany, or a German Europe? Or perhaps the answer is already clear in economic terms. Now, the defense sector is ramping up rapidly, positioning Germany not only as the EU’s economic giant but also as a rising military heavyweight.

Germany already boasts a formidable defense industry and ranks fifth in global arms exports. However, it has embarked on a sweeping restructuring of its armed forces. As of April 30, 2025, official figures record around 182,500 active-duty personnel (62,000 in the army) and 34,600 reservists. The new strategic plan envisions expanding to 240,000 active troops and 260,000 reservists — a combined force of half a million in the coming years.

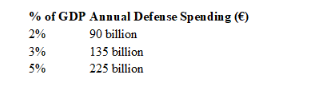

In 2022, Berlin established a €100 billion Special Fund to surpass NATO’s 2% GDP benchmark, aiming for 3% and ultimately 5%. In 2025, with GDP estimated at €4.5 trillion, that translates into the following defense budgets:

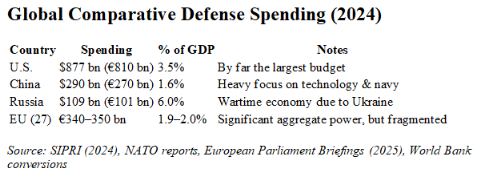

At these levels, Germany would rank as the world’s third-largest defense spender, behind only the United States and China. In 2024, the U.S. defense budget stood at $877 billion (3.5% of GDP), and China’s at $290 billion (1.6%).

Two major structural changes are required: First, an overhaul of the economic model to channel more resources into domestic defense manufacturing, ensuring self-sufficiency and expanding exports so that defense spending does not erode other priorities like social welfare or green development. Second, a fundamental restructuring of the armed forces — accompanied by a gradual shift in strategic doctrine under the shadow of renewed Russian aggression.

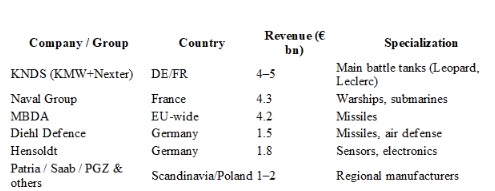

Germany’s defense industry — led by Rheinmetall (tanks, artillery), Krauss-Maffei Wegmann (Leopard tanks), ThyssenKrupp Marine Systems (submarines), and Diehl Defence, Hensoldt, MBDA Germany (missiles, electronics) — is set to gain the most. This expansion will mean new factories, infrastructure, AI, cyber capabilities, subsidies, legislative support, and leadership in EU-wide defense programs such as SAFE.

Bundeswehr Structure (2025)

4 Divisions

- 1st Armoured Division

- 10th Armoured Division

- Rapid Forces Division – light / airborne

- Internal Defense and Critical Infrastructure Division

9 Brigades

- 8 active brigades on German soil

- 1 under formation in Lithuania (Panzerbrigade 45)

Participation in NATO, EU, and Other Operations

- NATO Enhanced Forward Presence (eFP)

- 1,000–1,500 troops in Lithuania, leading the multinational battlegroup

- From 2025, establishing a permanent German armoured brigade (Panzerbrigade 45), aiming for 5,000–6,000 troops by 2027

- Very High Readiness Joint Task Force (VJTF)

- Germany is the core of NATO’s high-readiness force for 2023–2025, with 8,000–10,000 troops on standby

- Eurocorps / Multinational Corps North-East

- Staff-level participation in multinational corps commands

Non-NATO External Missions

- Mali (former MINUSMA mission – now withdrawing)

- Kosovo (KFOR) – approx. 70 troops

- Iraq (training) – approx. 100 troops

- Naval missions in the Mediterranean and Red Sea – frigates and security personnel

- Total German personnel deployed abroad in 2025: approx. 2,500 troops

Fragmentation of EU Hard and Soft Power

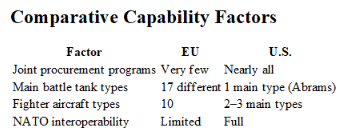

While the EU ranks second globally in total defense spending, this does not translate into a single, unified deterrent capability, for several reasons:

- Fragmentation among member states – Each spends and invests according to its own national interests.

- Institutional limits – The EU is neither a federation nor a confederation; it is a club of sovereign states with diverging priorities. Even perceived threats differ — for Greece and Cyprus, Turkey is the primary concern; for most others, it’s Russia.

- Industrial diversity – A mix of state-owned and private firms, producing a wide variety of weapon systems (from rifles to tanks) leads to interoperability gaps.

- Lack of autonomous defense – The EU is dependent on the U.S. and NATO, with NATO ties being institutional. The EU has yet to decide whether to evolve from a soft power into a hard power.

Germany’s planned spending increase and structural reforms point toward it becoming a hard power within NATO and the EU — changing the balance from the Germany we knew to one with full-spectrum influence. The U.S. will remain the “big brother” within NATO, potentially acting as a brake on overambitious German moves.

Institutional Role and the Veto

If the veto on defense and foreign policy were abolished, Germany’s influence would grow dramatically. Even with safeguards, large states — particularly a militarily empowered Germany — would dominate. Without a common defense and foreign policy, Germany will still proceed, moving from being first among equals to the undisputed leader. Unless others like France, Italy, Spain, and Poland join the arms race, they risk strategic marginalization.

The EU’s integration process is naturally producing a hierarchy of states, alliances of convenience, and national-interest-driven blocs — dynamics that a militarily dominant Germany could shape to its advantage.

Total defense industry turnover: approx. €60–80 bn (2023–2024), projected to grow substantially in coming years as defense budgets approach at least 3% of GDP — with Germany committed to 5%.

The map depicts the German Armed Forces. Through the structural changes being implemented, Berlin is preparing to dominate not only economically but also militarily within the EU, with all that this may entail.

This map shows the German air and naval forces, which expect that through technology they will become even more capable, in order to strengthen both their own deterrence and that of the EU.